You’ve worked hard to earn your money and investing it can help make your finances work for you, growing over time and giving you the freedom to spend it on whatever you like.

We cannot give investment advice – that is we cannot tell you where to invest your money or recommend any investment products – but we can give some general pointers. And, of course, no one can tell you how to make millions trading shares and retire by Friday sadly; the good news is getting wealthy slowly is not necessarily hard, but it takes commitment, discipline, knowledge and probably professional advice.

Why invest?

This is personal to each individual. Maybe you’re saving up to send the children to private school, to buy a house, retire early or travel the world. Whatever the reason, investing can help build up your personal wealth.

It’s important to consider timeframes here. Anything less than five years is a very short time frame for investing and, generally, the longer you invest for the less the risk.

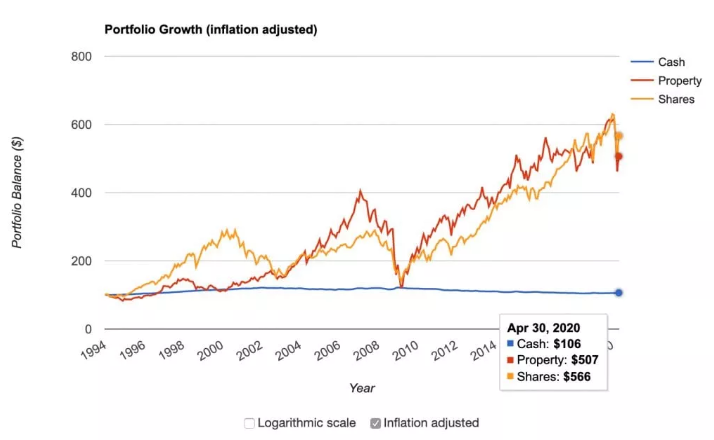

Here’s a graph that shows how the inflation adjusted returns of $100 invested in 1994 in shares, property and cash.

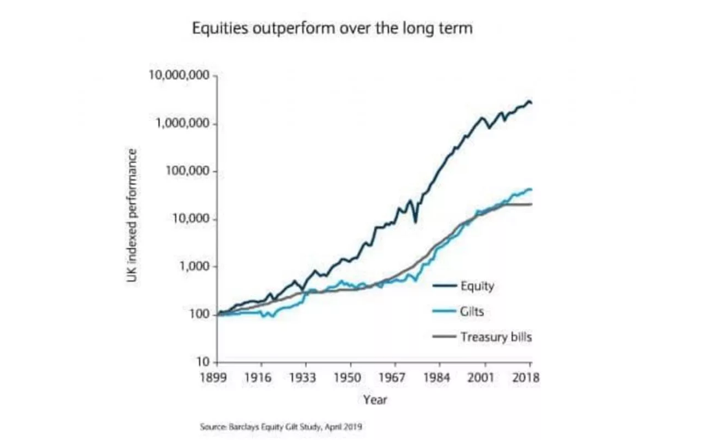

Here’s another graph that shows the performance of £100 invested in 1899 in three different asset classes – equities (aka shares), gilts and Treasury bills. The key thing to note is the timescales and general trends.

Start early to maximise compound interest

Our first tip regarding investing is to start early because by doing so you can take advantage of compound interest. If you invest £200 a month from the age of 25 till age 65 at an investment rate of 5.75% you would end with £368,900. If you do the same but start at age 35 till age 65 you will end with £192,000. The difference of £176,900 comes from being able to take advantage of compound interest for an extra

Asset classes

There are several different assets that individuals can invest in. Note that like medicine, there’s a confusing vocabulary around investing. Learning the language can help to demystify what is essentially a simple concept – give some of your money to someone else and at the end they might give you back more (or less) than you gave them at the start.

Cash: Likely the asset class you are most familiar with. Cash can produce interest income and is seen as risk-free and easy to access. It is important to have some of your investment portfolio in cash because you will want an easily accessible emergency fund. However, cash has some big downsides – it does not provide any potential for growth and inflation will reduce the real value of cash over time (unless the interest rate exceeds the rate of inflation which is rare.) At the time of writing, inflation is at relatively high levels, reducing the real value of cash.

Bonds aka ‘fixed interest securities’: These are a way of loaning money to the organisation issuing the bond, usually a government or a company. It’s effectively an IOU between the investor and whoever issued the bond. In the UK government issued bonds are called gilts. They provide a fixed income for a fixed term with repayment of the initial capital at the end of the bond’s term. They can be vulnerable to general interest rates however and the value of the bond can fall. There is also a (usually very small) risk that the issuer of the bond fails to make income payments or repay the bond (gilts are rated as very safe).

Shares: Also called stocks or equities, shares are units of a company that can be bought and sold. The value of the share fluctuates which can provide for potential capital growth – it is generally accepted that shares offer the potential for significantly higher growth than deposit-based investments as the graphs above showed. However, investing directly in shares can be quite risky with the potential for partial or total capital losses if the share value falls. Share prices can fluctuate significantly especially over the short term and should be seen as longer-term investments. If you own shares there is the potential that you will be paid dividends though this is not guaranteed.

Funds: These include collective investment funds, exchange traded funds, investment trusts and so on and are ways to buy a selection of investments. These can be actively managed by a fund manager who picks and chooses investments or passively managed, which simply tracks the performance of the market they are tracking. Funds are seen as a way to reduce the risk of investing in shares directly.

Commodities: These are physical assets such as precious metals, like gold, energy, like oil, or even agricultural assets like grain, that can be invested in.

Property: Property – residential or commercial property – can be invested in and provides the potential for capital growth if the value of the property rises and also the potential for income by charging rent. Property is vulnerable to economic conditions however. Property is also not ‘liquid’ that is if you need cash quickly you are unable to be able to sell the property quickly to convert it into cash. There are also management costs of owning property as an investment and tax implications that are beyond the scope of this article.

Invest tax efficiently

The good news is investing tax efficiently is very easy thanks to Individual Savings Accounts (ISA). There are many forms of ISAs, including Cash ISAs, Stocks and Shares ISAs, Lifetime ISA and Innovative finance ISA. Note that while they say ‘life begins at 40’, unfortunately your eligibility for a Lifetime ISA ends at 40 so if you are approaching this age you might want to look into setting up a LISA sooner rather than later.

Understand risk

Risk in relation to investing can be complex. The risk you’re probably most worried about with investment is ‘investment risk’, the risk you lose some or all of your money. But there’s also inflation risk – the risk that the value of an investment is effectively reduced by inflation which mainly applies to cash. Generally, the higher the risk though, the greater the potential return.

Understanding your own appetite for risk is essential to getting the correct investments for you. If you get your appetite for risk wrong, the first time your investments go down, you will panic. A good financial adviser will include a detailed assessment of your risk as part of your investment plan.

Holding a wide range of investments for a longer timeframe is a proven way to mitigate risk whereas buying individual shares is seen as extremely risky. Whilst you may get lucky occasionally, we are looking for consistent returns over a very long time and being consistently lucky is not a reliable investment strategy. Investing in funds provides an easy way to invest in many shares and diversify and mitigate some of that risk.

Another key part of reducing risk is the asset allocation in your portfolio. Asset allocation describes how you split your investments amongst the various asset classes: cash, shares, bonds and property. Matching asset allocation to your risk and your goals is essential and something that a good financial adviser will help you with. If you are young, investing for the long term, and happy to take significant risk, you might hold a portfolio mostly in equities (higher risk). Of course, everyone is different and everyone has their own attitude to risk and own personal needs. Risk is a massive subject and understanding your tolerance for it and how you will mitigate it is essential for successful investing.

Minimise costs

The costs of investing come from three main areas:

1) Fund costs

Active funds (see definitions) use experienced managers to try and pick the best investments and you will pay extra for this over passive tracker funds.

2) Platform costs

Most individuals will buy and hold investments through a “platform”. These platforms charge varying fees for holding your investments. Research the costs carefully and be aware that the costs of holding the same fund can vary significantly depending on the platform

3) Advice and time costs

If you choose a financial adviser to get investment advice you will then pay for that advice. At Medics’ Money we believe in good advice for the right price. Not only do we only recommend advisers that fulfil our rigorous criteria for quality, but we also only recommend advisers that charge fair and transparent fees for advice.

But what is a fair price? Well the average fee that Medics’ Money advisers charge for setting up your investments is 3% of the investment amount. Some offer a fixed fee for larger or smaller amounts. If you want the adviser to look after your investments long term the ongoing management charges are around 1%, with most significantly lower than this. If you have a large portfolio, you should expect a reduction in the % fees. None of the advisers on Medics’ Money charge any exit fees.

Which brings me to the final cost, your time. If you are going to manage your own investments, you are going to need to allocate significant time to doing so. For busy, high income, professionals like doctors, its highly likely that our time would be best spent earning money being a doctor or enjoying some downtime. As long as the advice you are paying for is the right advice, for a fair price.

Should I get advice?

If I give a stockbroker a stethoscope, they don’t become a doctor. If doctors are given a share trading account, they don’t become stockbrokers. Take advice from qualified individuals.

There’s nothing stopping you from opening a stocks and shares ISA right now and buying shares or funds. There’s also a wealth of information on the internet that could allow you to educate yourself on investing. You could invest in a well-diversified, low-cost portfolio in a tax efficient wrapper like a stocks and shares ISA for 30 years and will likely achieve reasonable returns. At Medics’ Money we encourage you to take control of your own finances and provide the resources to enable you to do this wherever possible. However, if at any point you would like a free consultation with a Medics’ Money approved independent financial Adviser you can find one here:

https://www.medicsmoney.co.uk/find-a-specialist-medical-ifa/